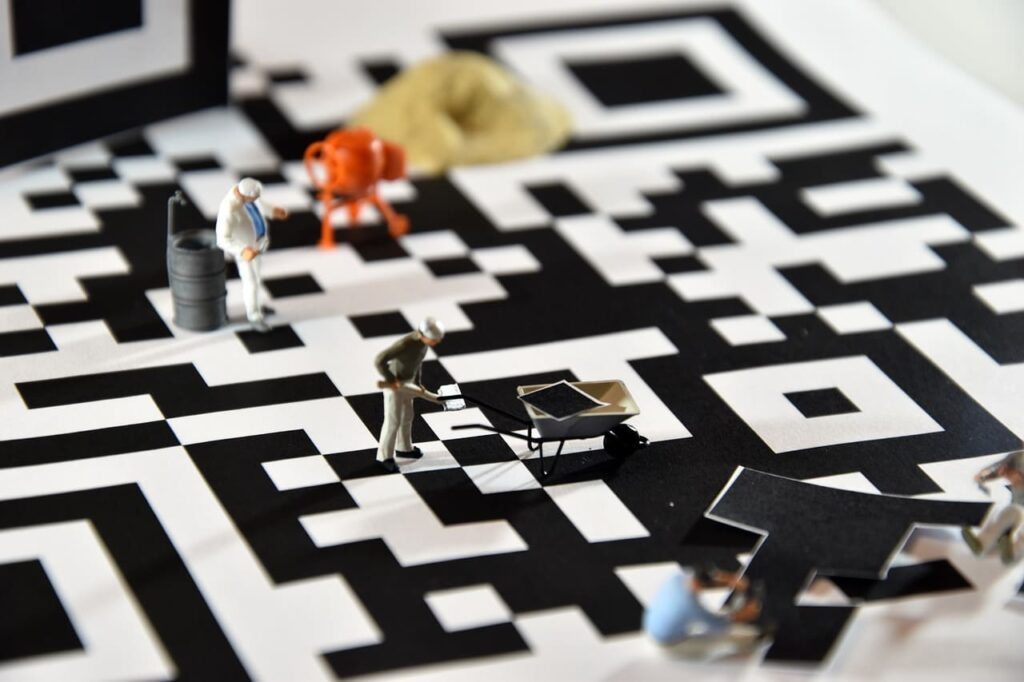

A Guide on Utilizing QR Codes in the Insurance Sector

One of the key areas where QR codes can be utilized in the insurance industry is the claims process. By incorporating QR codes into claim forms and documents, insurers can expedite the process and reduce paperwork.

Originally developed for inventory tracking, codes have found their way into various industries, including the insurance sector. QR codes provide a convenient and efficient way to share information, engage customers, and streamline processes. In this article, we will explore how the insurance industry can make effective use of QR codes.

1. Streamlining the Claims Process

QR codes can also be used to enhance policyholder engagement. Insurance companies can include QR codes on policy documents, brochures, and marketing materials to provide policyholders with additional information.

2. Enhancing Policyholder Engagement

Policyholders can simply scan the QR code to access relevant information, submit documents, and track the progress of their claims. This not only saves time but also enhances customer satisfaction by providing a seamless experience.

For example, scanning a QR code on a policy document can lead the policyholder to a webpage with FAQs, contact information, or even a video explaining the coverage in detail. This interactive approach helps policyholders better understand their policies and builds trust with the insurance company.

3. Promoting Insurance Products and Services

Insurance companies can leverage QR codes to promote their products and services. By placing QR codes on advertisements, billboards, or even social media posts, insurers can direct potential customers to landing pages where they can learn more about the offerings.

This not only increases brand visibility but also allows insurers to track the effectiveness of their marketing campaigns by monitoring the number of scans. Additionally, QR codes can be used to provide instant quotes or facilitate the purchase of insurance policies online, making it convenient for customers to access and avail themselves of insurance services.

4. Improving Customer Feedback and Surveys

QR codes can be a valuable tool for collecting customer feedback and conducting surveys. Insurance companies can include QR codes on customer satisfaction forms or send them via email or SMS. When scanned, these codes can lead customers to online surveys or feedback forms, allowing insurers to gather valuable insights and improve their services.

By making the feedback process quick and easy, insurers can encourage more customers to participate, leading to a more comprehensive understanding of customer needs and preferences.

5. Enhancing Fraud Prevention

In QR codes offer numerous benefits for the insurance industry. From streamlining the claims process to enhancing policyholder engagement and promoting products and services. By embracing this technology, insurance companies can improve customer satisfaction.

QR codes can also play a role in enhancing fraud prevention efforts in the insurance industry. By incorporating unique QR codes on policy documents or identification cards, insurers can verify the authenticity of the documents during claims processing. This can help detect and prevent fraudulent activities, ultimately reducing losses for insurance companies and ensuring a fair and transparent claims process.